As a User Researcher at Intuit, I specialized in the TurboTax product, a leading tax preparation software. My role centered on enhancing the TurboTax user experience by deeply understanding user needs, behaviors, and pain points. Through rigorous research and analysis, I provided actionable insights that guided the design and development of TurboTax, making tax preparation simpler and more intuitive for users.

Key Projects and Achievements

TurboTax User Experience Enhancement

Improving User Guidance and Support

Objective

To improve user guidance within TurboTax, ensuring that users receive timely and relevant help throughout the tax preparation process.

Approach

Contextual Inquiry: Conducted contextual inquiries to observe users in their natural environments, understanding how they navigate TurboTax and seek assistance.

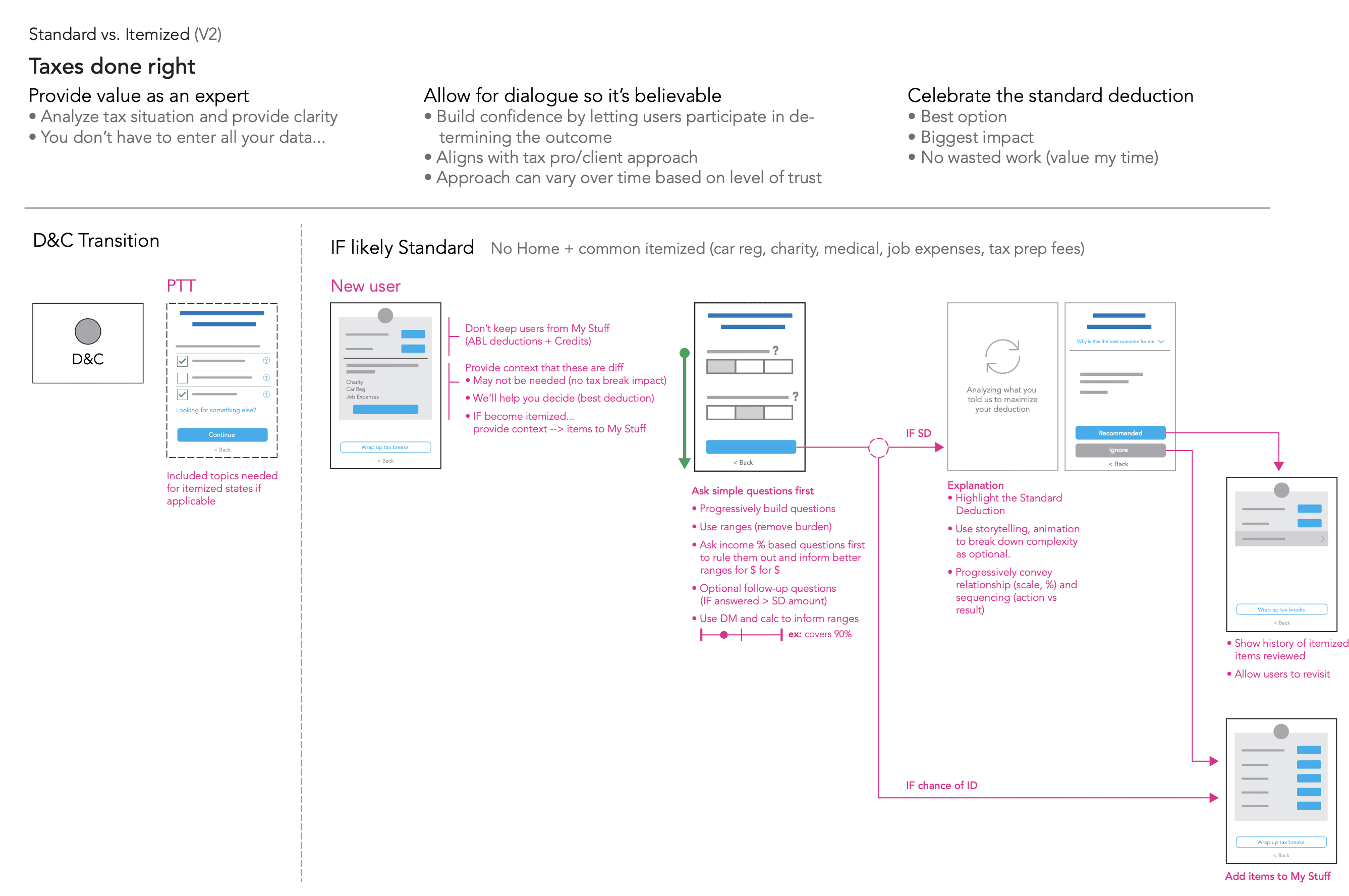

User Journey Mapping: Developed detailed user journey maps to visualize user interactions and identify moments when users required support or guidance.

Prototype Testing: Collaborated with the design team to create and test prototypes of new guidance features, such as in-app tutorials and contextual help prompts.

Outcomes

Introduced an enhanced in-app help system that provided contextual assistance based on user actions, resulting in a 25% reduction in help request volume.

Developed and implemented interactive tutorials that guided users through complex tax scenarios, leading to a 15% increase in user confidence and a decrease in task abandonment rates.

3. Designing for Diverse User Needs

Objective

To address the diverse needs of TurboTax users, including those with varying levels of tax knowledge and experience.

Approach

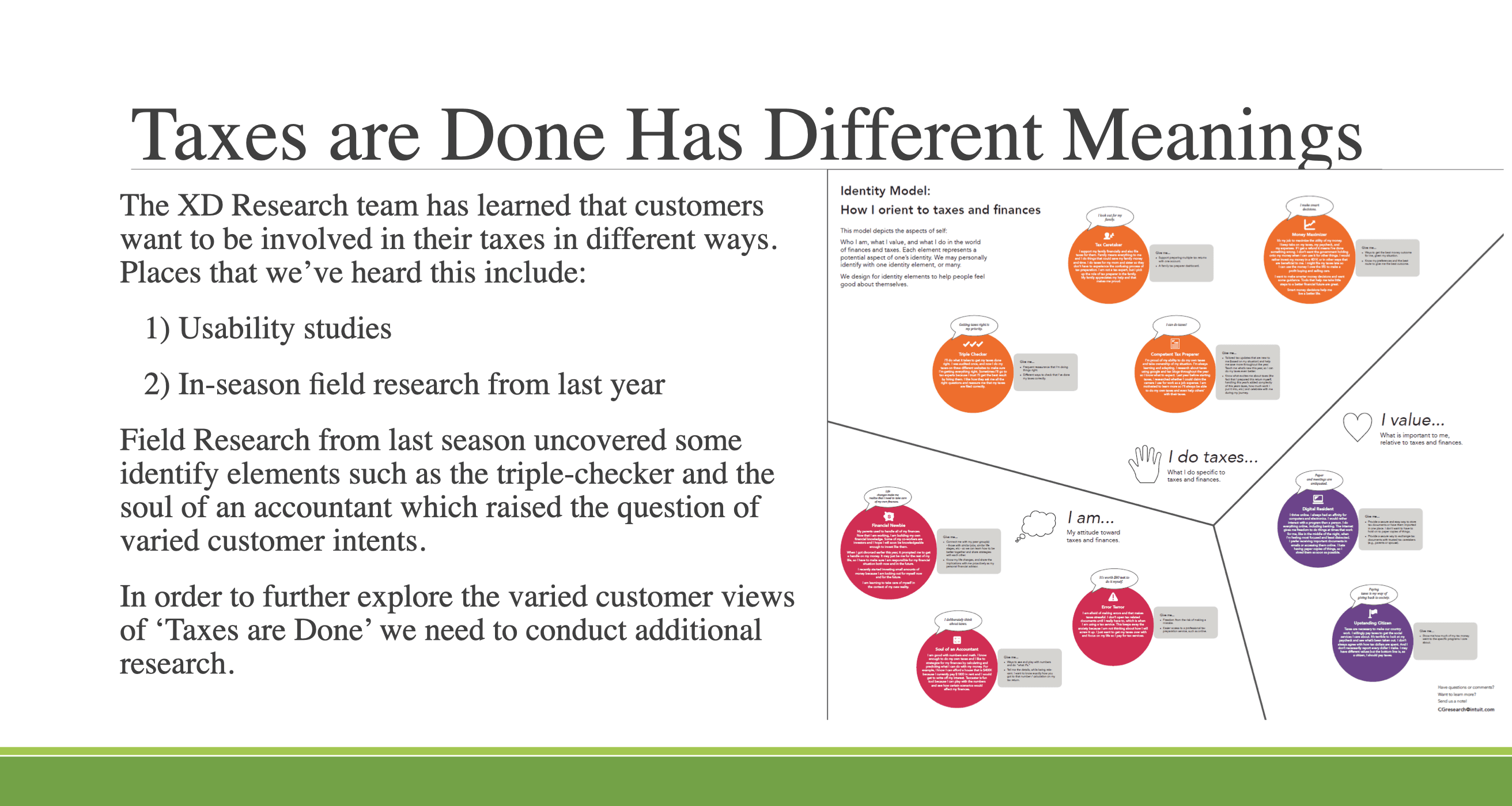

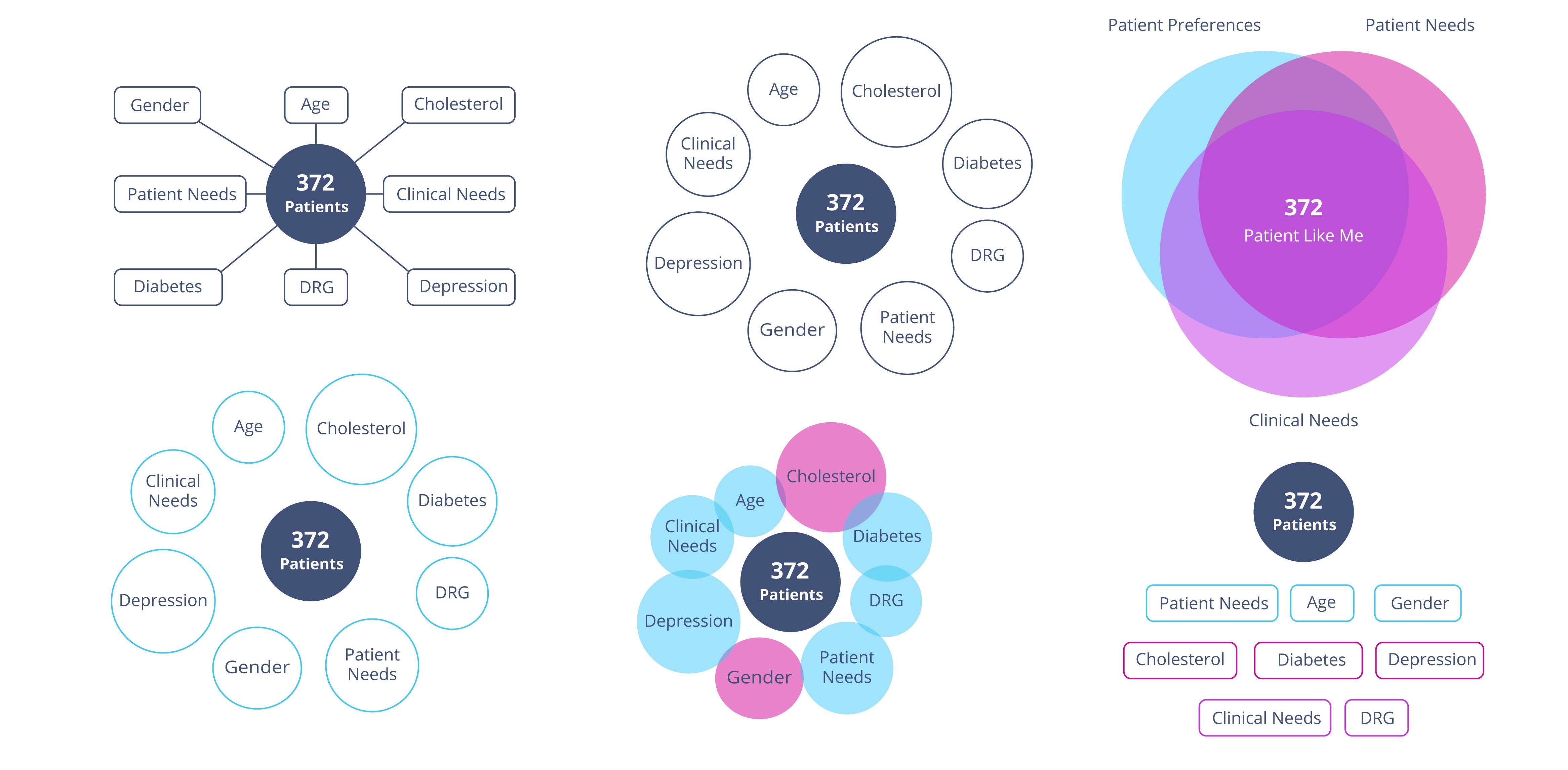

Persona Development: Created detailed personas representing different segments of TurboTax users, such as first-time filers, freelancers, and small business owners.

Survey Research: Conducted surveys to gather quantitative data on user demographics, tax filing behaviors, and software preferences.

Focus Groups: Facilitated focus groups with diverse user segments to gather qualitative insights and validate persona-driven hypotheses.

Outcomes

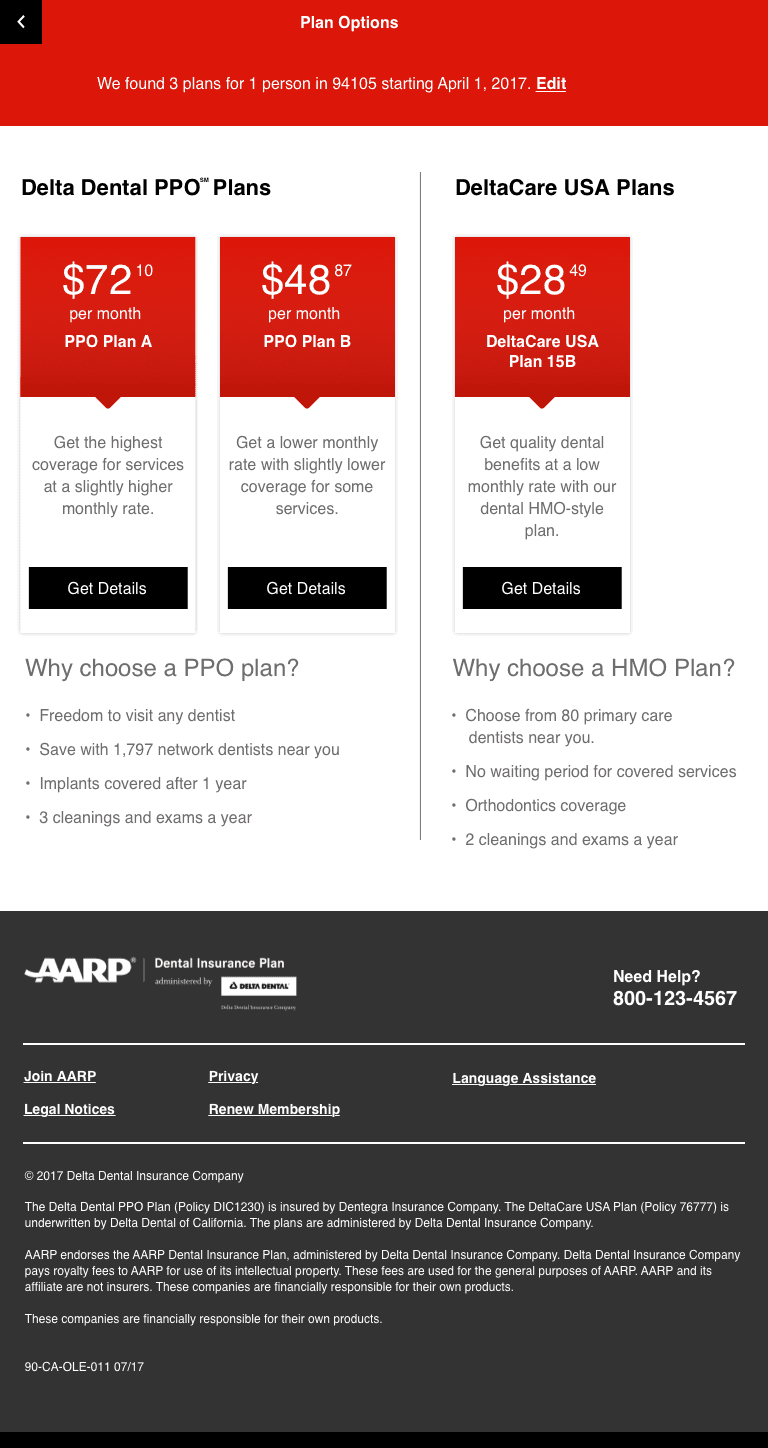

Informed the design of tailored experiences for different user segments, such as simplified interfaces for first-time users and advanced features for experienced filers.

Enhanced the TurboTax onboarding process by creating personalized pathways based on user profiles, leading to a more customized and engaging user experience.

As a User Researcher for TurboTax at Intuit, I played a crucial role in understanding and addressing user needs to enhance the TurboTax experience. By leveraging a mix of research methodologies and collaborating closely with design and development teams, I contributed to creating a more intuitive, user-friendly tax preparation process that caters to the diverse needs of TurboTax users.